Trizic

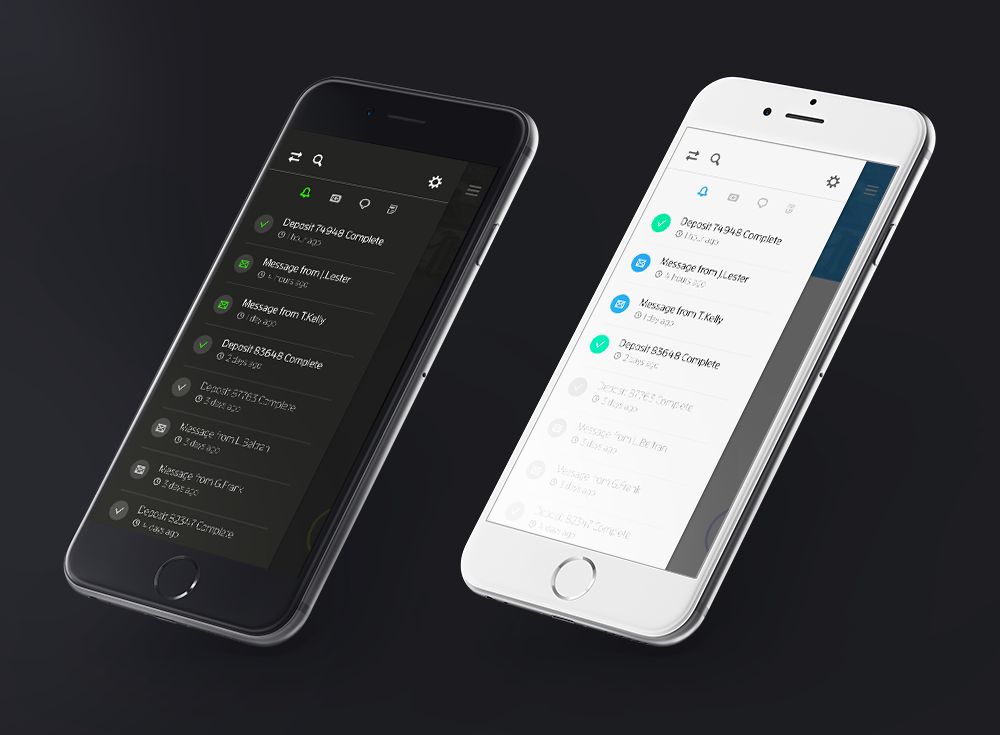

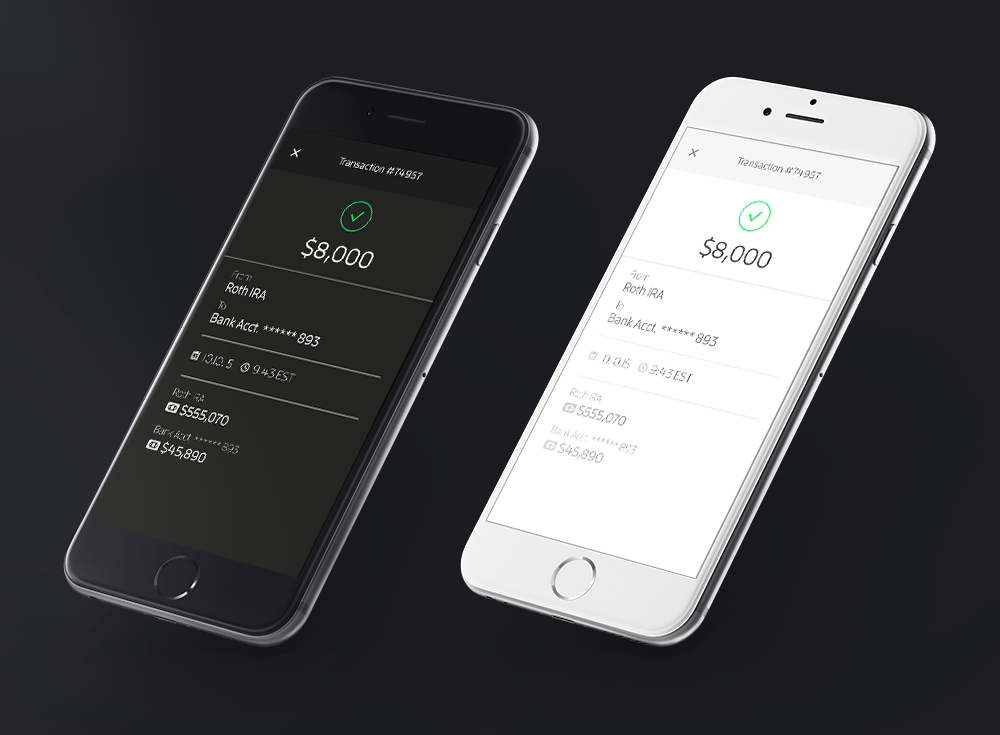

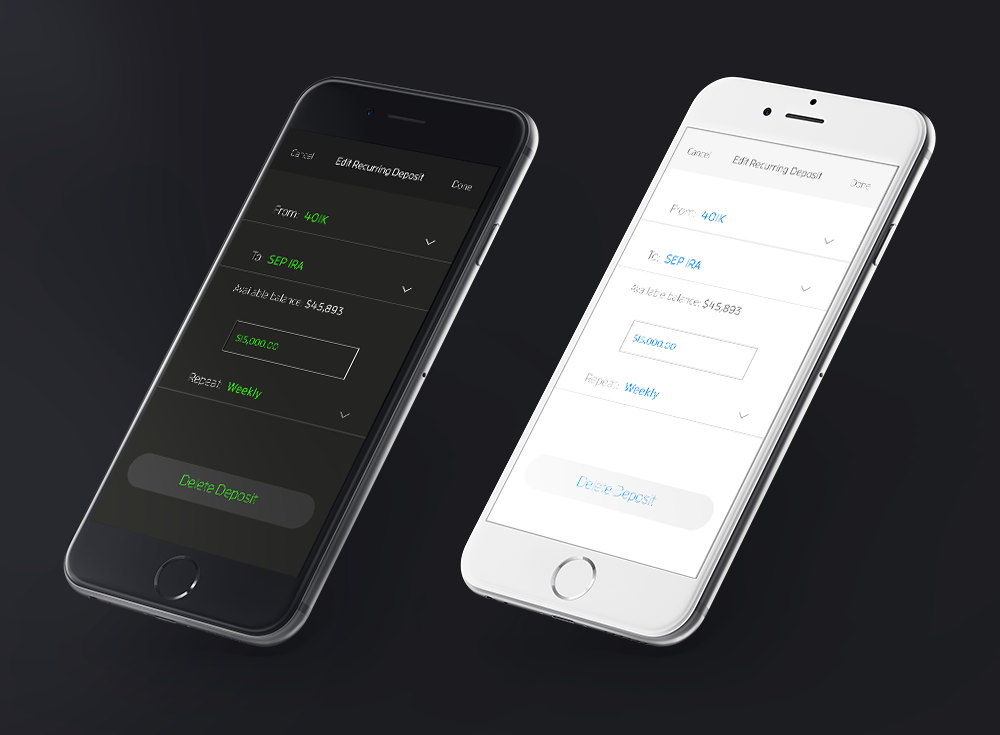

Trizic is a white label, financial services iOS application that allows clients to interact with their personal investment portfolios. Uncomplicated charts and easy-to-read tables explain clearly at a glance what is happening with a user’s finances - users can also drill down to see all of their more granular investment data. Easily transferring money in and out of accounts gives users the access they expect in this day and age, and allows for maximum control and flexibility. View account statements, trade confirmations and tax documents with a simple tap. Trizic is money made mobile.

View wireframe →

Visit public site →

View wireframe →

Visit public site →

Overview

- Provided Trizic with the branding and visual identity necessary to launch their startup. Assets provided were to be rolled out across their digital properties.

- Oversaw production of the iOS application and certified that all design was being implemented according to spec.

- Worked very closely with the founding team to discern what the MVP application was trying to achieve. From there, proposed relatively simple design solutions, involving financial data visualization, to accomplish their business goals.

- Established and maintained an iterative design process with key stakeholders to craft an intuitive interface. Communicated ideas through the use of flow charts, wireframes, and prototypes.

Key Findings

If we attempt to sell products

and services to people before

they’re ready, we will lose them

forever.

- Only 26% of respondents indicated a high level

of comfort managing their finances.

-

For many, disposable income is the goal.

-

They disengage when confused or frustrated.

-

These trends change as workers transition

into management, as income and comfort

levels increase over time and with experience.

Retirement is separate and

distinct from other offerings,

both from a B2B and B2C

perspective.

-

83% of plan participants report wanting better

tools to meet retirement specific needs

-

For both plan sponsors and participants, the

order of operations is inflexible, they must see

to retirement before considering other options

- Retirement nearly triples the take-up rate of financial wellness apps across all roles and industries.

Monetizing the rank and file at

scale may be more profitable

than waiting for a wealth

management relationship.

Concerns and anxiety around being able to retire comfortably are top of mind when it comes to financial wellbeing.

Concerns and anxiety around being able to retire comfortably are top of mind when it comes to financial wellbeing.

- 70% of workers report having been stressed out about their finances in the past year

- 74% of workers report retirement as their top concern regarding their financial well being.

- Only ~31% participate in financial wellness plans when offered one by their employers.

Interface